The Greatest Guide To Top 30 Forex Brokers

Wiki Article

About Top 30 Forex Brokers

Table of ContentsAll About Top 30 Forex BrokersThe Best Strategy To Use For Top 30 Forex BrokersTop 30 Forex Brokers Things To Know Before You Get ThisSome Known Incorrect Statements About Top 30 Forex Brokers Top 30 Forex Brokers Fundamentals ExplainedIndicators on Top 30 Forex Brokers You Should KnowGetting The Top 30 Forex Brokers To WorkNot known Details About Top 30 Forex Brokers

Each bar chart represents one day of trading and has the opening cost, greatest rate, most affordable rate, and shutting rate (OHLC) for a profession. A dash on the left represents the day's opening price, and a comparable one on the right represents the closing rate.Bar charts for money trading assistance traders identify whether it is a purchaser's or vendor's market. The upper section of a candle is utilized for the opening cost and highest price point of a money, while the reduced section shows the closing price and most affordable rate factor.

Top 30 Forex Brokers for Beginners

The developments and shapes in candlestick charts are made use of to recognize market instructions and movement.Financial institutions, brokers, and suppliers in the foreign exchange markets permit a high quantity of utilize, indicating traders can manage big placements with relatively little money. Leverage in the series of 50:1 prevails in foreign exchange, though even better amounts of leverage are available from specific brokers. Leverage needs to be utilized cautiously because several inexperienced investors have suffered substantial losses using even more utilize than was needed or sensible.

Some Known Details About Top 30 Forex Brokers

A money investor needs to have a big-picture understanding of the economic climates of the numerous countries and their interconnectedness to understand the basics that drive currency worths. The decentralized nature of foreign exchange markets indicates it is less regulated than various other financial markets. The level and nature of regulation in foreign exchange markets depend upon the trading territory.The volatility of a certain currency is a feature of multiple factors, such as the national politics and economics of its nation. Occasions like economic instability in the form of a repayment default or discrepancy in trading relationships with one more money can result in substantial volatility.

Everything about Top 30 Forex Brokers

The Financial Conduct Authority (https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1704973262&direction=prev&page=last#lastPostAnchor) (FCA) monitors and regulates foreign exchange trades in the UK. Money with high liquidity have a ready market and show smooth and predictable rate action in response to outside events. The U.S. dollar is one of the most traded money on the planet. It is paired up in six of the marketplace's seven most fluid currency sets.

Getting The Top 30 Forex Brokers To Work

In today's info superhighway the Foreign exchange market is no more only for the institutional investor. The last 10 years have seen a rise in non-institutional investors accessing the Forex market and the benefits it uses. Trading systems such as Meta, Quotes Meta, Investor have actually been established especially for the personal investor and academic material has actually ended up being quicker offered.

Get This Report on Top 30 Forex Brokers

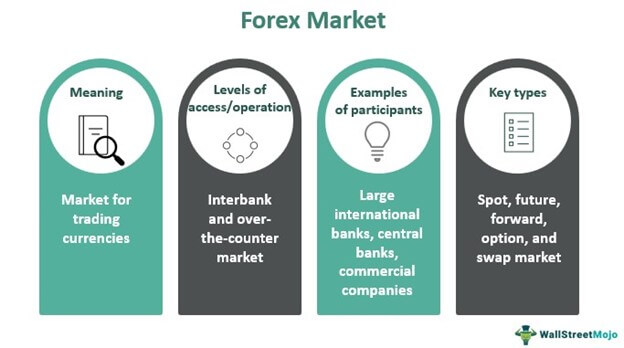

International exchange trading (forex trading) is an international market for acquiring and selling money - Tickmill. 6 trillion, it is 25 times larger than all the globe's supply markets. As a result, rates transform frequently for the money that Americans are most likely to utilize.

When you sell your money, you get the payment in a various money. Every vacationer who has obtained foreign currency has actually done forex trading. The investor purchases a specific currency at the buy cost from the market maker and markets a different money at the selling cost.

This is the deal cost to the investor, which consequently is the profit made by the market manufacturer. You paid this spread without understanding it when you traded your bucks for international money. You would see it if you made the transaction, canceled your journey, and after that tried to exchange the currency back to bucks today.

The 9-Minute Rule for Top 30 Forex Brokers

You do this when you think the money's worth will certainly drop in the future. Companies short a currency to safeguard themselves from threat. Yet shorting is extremely risky. If the money climbs in worth, you need to purchase it from the dealership at that cost. It has the same pros and disadvantages as short-selling supplies.Report this wiki page